IRS Wants to Pay $625,000 for Tools to Track Monero

The United States Internal Revenue Service is offering $625,000 for Monero-tracing software, according to a recently published proposal request.

In the proposal request, the IRS described the need for “innovative solutions for tracing and attribution of privacy coins,” including Monero and the Bitcoin Lightning Network.

The use of privacy coins is becoming more popular for general use, and is also seeing an increase in use by illicit actors," the IRS wrote in the proposal. “Currently, there are limited investigative resources for tracing transactions involving privacy cryptocurrency coins such as Monero, Layer 2 network protocol transactions such as Lightning Labs, or other off-chain transactions that provide privacy to illicit actors.”

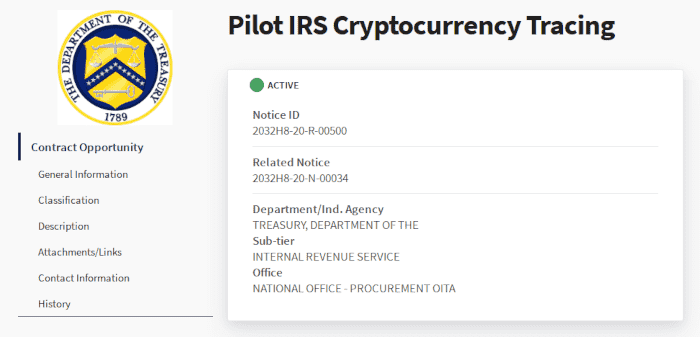

A screenshot of the IRS proposal request

The relevant portion of the proposal is below:

IRS-CI is seeking a solution with one or more Contractors to provide innovative solutions for tracing and attribution of privacy coins and Layer 2 off-chain transactions, such as expert tools, data, source code, algorithms, and software development services to assist their Cyber Crimes agents in carrying out their mission as it relates to cryptocurrency privacy technologies. These should support one of the outlined initiatives on Monero or Layer 2 network protocol transactions, or other cryptocurrency obfuscation technologies.

Under the overall direction of the Director of Cyber Crimes or their designee, the Contractor shall provide weekly status reports of progress to include major accomplishments, upcoming tasks, and issues or concerns. The Contractor shall work with CI Cyber Crimes personnel, Cyber Special Agents; business and functional points of contact; and other personnel, including other contractors, to gather and synthesize data and other inputs as needed. All documentation, data, source code, and software developed shall be provided to IRS-CI.

The primary goals of this solution challenge are:

- Provide information and technical capabilities for CI Special Agents to trace transaction inputs and outputs to a specific user and differentiate them from mixins/multisig actors for Monero and/or Lightning Layer 2 cryptocurrency transactions with minimal involvement of external vendors

- Provide technology which, given information about specific parties and/or transactions in the Monero and/or Lightning networks, allows Special Agents to predict statistical likelihoods of other transaction inputs, outputs, metadata, and public identifiers with minimal involvement of external vendors

- Provide algorithms and source code to allow CI to further develop, modify, and integrate these capabilities with internal code and systems with minimal costs, licensing issues, or dependency on external vendors All solutions must support cryptocurrency transactions that occurred in 2020.

All solutions for the must support open standards for interoperability (common file formats, REST APIs, etc. as appropriate) to facilitate easy integration into internally developed IRS-CI cryptocurrency analytic systems and data.

When responding, please keep the three above goals in mind. We are looking for solutions which provide the best results for tracing obfuscated cryptocurrency transactions using Monero and/or Lightning, however all three goals are important and a solution that produces good statistical likelihoods of transaction parties but does not provide easy to integrate source code will not be rated as highly as one that provides both source code that can be integrated with CI systems and produces good statistical likelihoods of transaction parties. Contractors may choose to submit solutions to address Monero or Lightning transactions, or both as all approaches will be considered. The exact method of solving these problems is unspecified as many different approaches may be viable. We expect contractors will offer solutions in the form of software development and source code, data feeds, standalone tools, or some combination of these, but these are not the only types of solutions that will be considered. Solutions that require extensive vendor involvement such as consulting services to trace cryptocurrency for each case (as opposed to general development services to built tools for CI) will likely not fully address these three goals. If proprietary tools are part of the proposed solution, contractors shall include details on any ongoing licensing and/or maintenance costs and information about APIs or other interoperability with CI’s internal cryptocurrency tracing systems.

The IRS is planning on spending $1 million this fiscal year on multiple proposals, according to the document.

Documents attached to the proposal:

Related: CipherTrace Provided Feds with “Monero Tracing” Tools