PayPal Closed Someone's Account for Running Tor Relays

PayPal apparently shut down a Tor supporter’s account in response to activities supporting Tor, according to the EFF.

According to the Electronic Frontier Foundation, PayPal shut down a Tor supporter’s account used to fund Tor nodes. PayPal is a company that actively enjoys conducting financial censorship and Larry Brandt, the victim of this story, frankly should have known not to use such a company.

The EFF called on PayPal to do some things in response to their handling of Brandt’s account. PayPal has no reason to enact the requested changes or concern itself with the demands of a non-profit. (One can think of the EFF as the Mozilla Foundation. There is even overlap with board members. Although Mozilla is pro-censorship when they feel like it.)

The fact that Tor is even on the radar of PayPal’s censorship department is concerning and likely a sign that this ban is just the start.

From the EFF’s blog, written by Ainey Reitman:

Larry Brandt, a long-time supporter of internet freedom, used his nearly 20-year-old PayPal account to put his money where his mouth is. His primary use of the payment system was to fund servers to run Tor nodes, routing internet traffic in order to safeguard privacy and avoid country-level censorship. Now Brandt’s PayPal account has been shut down, leaving many questions unanswered and showing how financial censorship can hurt the cause of internet freedom around the world.

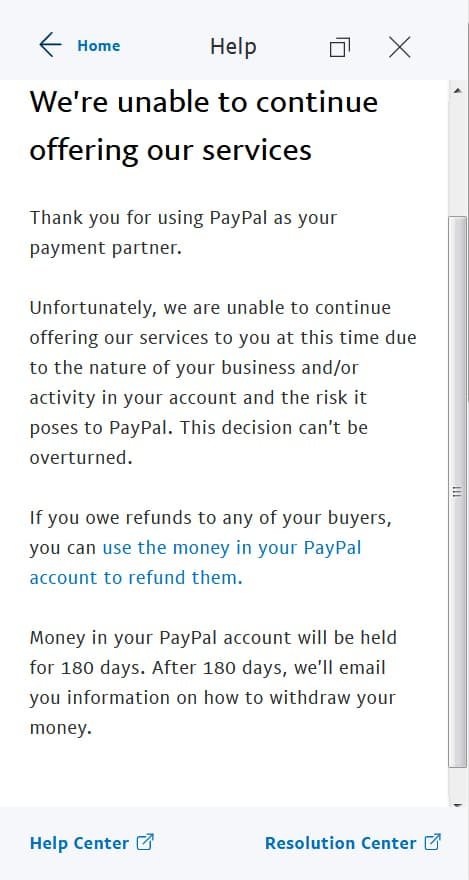

Brandt first discovered his PayPal account was restricted in March of 2021. Brandt reported to EFF: “I tried to make a payment to the hosting company for my server lease in Finland. My account wouldn’t work. I went to my PayPal info page which displayed a large vertical banner announcing my permanent ban. They didn’t attempt to inform me via email or phone—just the banner.”

Brandt was unable to get the issue resolved directly through PayPal, and so he then reached out to EFF.

For years, EFF has been documenting instances of financial censorship, in which payment intermediaries and financial institutions shutter accounts and refuse to process payments for people and organizations that haven’t been charged with any crime. Brandt shared months of PayPal transactions with the EFF legal team, and we reviewed his transactions in depth. We found no evidence of wrongdoing that would warrant shutting down his account, and we communicated our concerns to PayPal. Given that the overwhelming majority of transactions on Brandt’s account were payments for servers running Tor nodes, EFF is deeply concerned that Brandt’s account was targeted for shut down specifically as a result of his activities supporting Tor.

We reached out to PayPal for clarification, to urge them to reinstate Brandt’s account, and to educate them about Tor and its value in promoting freedom and privacy globally. PayPal denied that the shutdown was related to the concerns about Tor, claiming only that “the situation has been determined appropriately” and refusing to offer a specific explanation. After several weeks, PayPal has still refused to reinstate Brandt’s account.

The Tor Project echoed our concerns, saying in an email: “This is the first time we have heard about financial persecution for defending internet freedom in the Tor community. We’re very concerned about PayPal’s lack of transparency, and we urge them to reinstate this user’s account. Running relays for the Tor network is a daily activity for thousands of volunteers and relay associations around the world. Without them, there is no Tor—and without Tor, millions of users would not have access to the uncensored internet.”

One of the particularly concerning elements of Brandt’s situation is how automated his account shut down was. After his PayPal account was shuttered, Brandt attempted to reach out to PayPal directly. As he explained to EFF: “I tried to contact them many times by email and phone. PayPal never responded to either. They have an online ‘Resolution Center’ but I never had a dialog with anyone there either.” The PayPal terms reference the Resolution Center as an option, but asserts PayPal has no obligation to disclose details to its users.

Internet companies just aren’t incentivized to care about customer service.

Many online service providers make it difficult or impossible for users to reach a human to resolve a problem with their services. That’s because employing people to resolve these issues often costs more than the small amounts they save by reinstating wrongfully banned accounts. Internet companies just aren’t incentivized to care about customer service. But while it may serve companies’ bottom lines to automate account shut downs and avoid human interaction, the experience for individual users is deeply frustrating.

EFF, along with the ACLU of Northern California, New America’s Open Technology Institute, and the Center for Democracy and Technology have endorsed the Santa Clara principles, which attempt to guide companies in centering human rights in their decisions to ban users or take down content. In particular, the third principle is that “Companies should provide a meaningful opportunity for timely appeal of any content removal or account suspension.” Our advocacy has already pressured companies like Facebook, Twitter, and YouTube to endorse the Santa Clara principles—but so far, PayPal has not. Brandt’s account was shut down without notice, he was given no opportunity to appeal, and he was given no clarity on what actions resulted in his account being shut down, nor whether this was in relation to a violation of PayPal’s terms – and, if so, which part of those terms.

We are concerned about situations such as Brandt’s not only because of the harm and inconvenience caused to one user, but because of the societal harms from patterns of account closures. When a handful of online payment services can dictate who has access to financial services, they can also determine which people and which services get to exist in our increasingly digital world. While tech giants like Google and Facebook have come under fire for their content moderation practices and wrongfully banning accounts, financial services haven’t gotten the same level of scrutiny.

But if anything, financial intermediaries should be getting the most scrutiny. Access to financial services directly impacts one’s ability to survive and thrive in modern society, and is the only way that most websites can process payments. We’ve seen the havoc that financial censorship can wreak on online booksellers, music sharing sites, and the whistleblower website Wikileaks. PayPal has already made newsworthy mistakes, like automatically freezing accounts that have transactions that mention words such as “Syria.” In that case, PayPal temporarily froze the account of News Media Canada over an article about Syrian refugees that was entered into their annual awards competition.

EFF is calling on PayPal to do better by its customers, and that starts by embracing the Santa Clara principles. Specifically, we are calling on them to:

- Publish a transparency report. A transparency report will indicate how many accounts PayPal is shutting down in response to government requests, and we’d urge them to additionally indicate how many accounts they shut down for other reasons, including terms of service violations, as well as how many Suspicious Activity Reports they file. Other online financial services, including most recently Coinbase, have already begun publishing transparency reports, and there’s no reason PayPal can’t do the same

- Provide meaningful notice to users. If PayPal is choosing to shut down someone’s account, they should provide detailed guidance about what aspect of PayPal’s terms were violated or why the account was shut down, unless forbidden from doing so by a legal prohibition or in cases of suspected account takeover. This is a powerful mechanism for holding companies back from over-reliance on automated account suspensions.

- Adopt a meaningful appeal process. If a user’s PayPal account is shut down, they should have an opportunity to appeal to a person that was not involved in the initial decision to shut down the account.

Brandt agreed that part of the problem boils down to PayPal failing to prioritize the experience of users: “Good customer service and common sense would have suggested that they call me and discuss my PayPal activities or at least send me an email to tell me to stop. Then the company would be better equipped to make an informed decision about banning. But I think customer service is not so much in their best interests.”

Increased transparency into the patterns of financial censorship will help human rights advocates analyze patterns of abuse among financial intermediaries, and scrutiny from civil society can act as a balancing force against companies which are otherwise not incentivized to keep accounts on. For every example such as Brandt’s, in which a financial account was summarily shuttered without any opportunity to appeal, there are likely countless others that EFF doesn’t hear about or have an opportunity to document.

For now, Brandt is not backing down. While he can’t use PayPal anymore, he’s still committed to supporting the Tor network by continuing to pay for servers around the world using alternative means, and he urges other people to think about what they can do to help support Tor in the future: “Tor is of critical importance for anyone requiring anonymity of location or person….I’m talking about millions of people in China, Iran, Syria, Belarus, etc. that wish to communicate outside their country but have prohibitions against such activities. We need more incentives to add to the Tor project, not fewer.” For answers to many common questions about relay operation and the law, see the EFF Tor Legal FAQ.