Two Marijuana Dealers Sentenced for Laundering Bitcoin

A father and son were sentenced to five years in prison for marijuana distribution and money laundering.

U.S. District Judge John C. Coughenour sentenced Kenneth Warren Rhule (K. H. Rhule), 28, to five years in prison for conspiracy to manufacture and distribute marijuana and laundering monetary instruments. The judge sentenced Kenneth John Rule (K. J. Rhule), 47, to five years in prison for conspiracy to manufacture and distribute marijuana.

“Not only did this pair produce and distribute marijuana products on the dark web, in violation of the state’s regulatory scheme, they also illegally laundered immense amounts of bitcoin that their enterprise earned,” said U.S. Attorney Nick Brown. “When law enforcement moved in there were more than a dozen firearms – some loaded and ready to be used to protect their drug trade.”

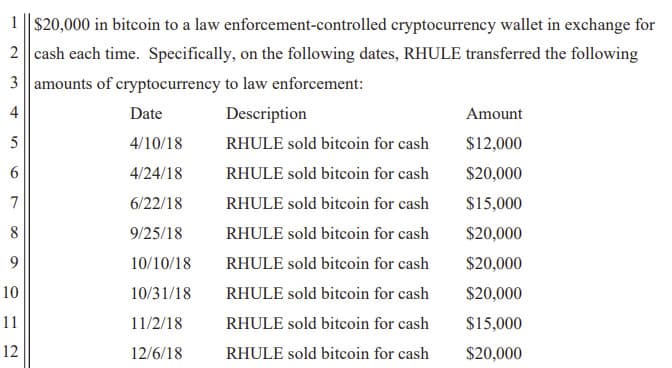

Altogether, Rhule exchanged $142,000 worth of bitcoin for cash with the undercover agent.

LocalBitcoins

In April 2018, federal investigators started meeting with the localbitcoins.com user “Gimacut93” to exchange cash for Bitcoin. “Through their conversations the undercover agent made it seem they were laundering money related to human trafficking activities,” according to the announcement from the U.S. Attorney’s Office for the Western District of Washington.

The criminal complaint detailed the investigation into the money laundering activities.

Investigators contacted Gimacut93 on localbitcoins.com and asked to meet to exchange $12,000 in cash for Bitcoin. Kenneth Warren Rhule met the undercover law enforcement officer at a Starbucks. While waiting for confirmations, K.W. Rhule told the undercover agent that he worked in the CBD industry, filling “5, 10, or 20,000-kilo orders.” He also told the agent that he was not charging a fee because he had a lot of Bitcoin he needed to move, and he usually needed to exchange $100,000 worth every month.

“In completing these transactions, the undercover agent represented the cash to be the proceeds of specified unlawful activity, as defined in 18 U.S.C. § 1956(c)(7), and K. W. Rhule acted with the intent to avoid a transaction reporting requirement under state or federal law, including those under the Bank Secrecy Act, 31 U.S.C. §§ 5313–26, and its implementing regulations. K. W. Rhule did not ask the undercover agent for any personally identifying information (such as full name, Social Security number, or taxpayer identification number) prior to, during, or after the transactions.”

At the next meeting, the undercover L.E.O. asked K. W. Rhule about anonymous transactions with cryptocurrency. The defendant then advised the L.E.O. to use Monero, Tails, and the Tor Browser. The L.E.O. told K. W. Rhule that he needed an anonymous way to accept payment from prostitutes in the Ukraine (this is what the press release described as “human trafficking”).

Investigators linked the company “HerbinArtisans” to the Rhule defendants.

After exchanging more than $120,000 in Bitcoin with the feds, Gimacut93 stopped responding to their text messages and ignored them on LocalBitcoins.

The phone number K. W. Rhule had given the undercover fed through LocalBitcoins was the same phone number used by the Instagram account “HerbinArtisans.” Although the account is now private and does not mention cannabis sales, investigators believe that K. W. Rhule used to reach customers through the account. The description for the account previously included “Bitcoin and crypto-friendly. D.M. for inquiries.”

On February 10, 2015, K. W. Rhule registered for an enterprise

account with Google, using the domain name herbinartisans.com. The defendant used a herbinartisans.com email address with the HerbinArtisans Instagram account.

Investigators obtained access to the Google account. They examined emails sent by both Rhule defendants, incriminating pictures stored in Google Drive, and SMS conversations between the father and son.

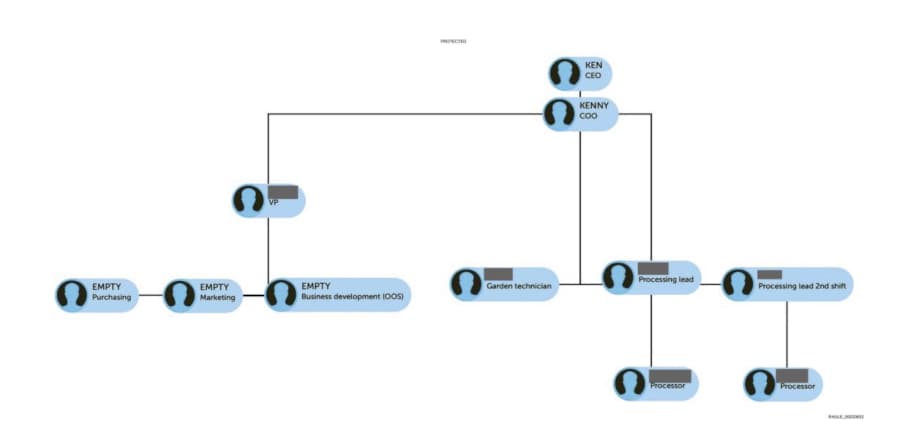

Google Drive

The HerbinArtisans’ Google Drive also contained an organizational chart, created on January 18, 2016, which listed “Ken” as the “C.E.O.,” while “Kenny”—a name used by K. W. Rhule—was listed as the “C.O.O.” of the organization. Other individuals, also known to be associated with HerbinArtisans, were listed in subordinate roles with the titles “Garden

technician,” “Processing lead,” “Processor,” and “V.P.” on the same chart.

The organization chart stored in Google Drive identified the defendants.

The defendants purchased a Cessna P210N, which they stored in Snohomish, Washington. The plea agreement indicates that the defendants used the plane to transport marijuana.

On April 24, 2015, K. J. Rhule texted K. W. Rhule, “Also, I have some KILLER deep web locations for selling…” Similarly, on May 16, 2015, K. J. Rhule texted K. W. Rhule, “Also, online deep web… Setup a couple order takers… The proceeds go into a bitcoin account we control… They send in the orders each day, we ship them, and we pay out the commission when the Bitcoin escrow is released…”

According to an Income Statement saved in the HerbinArtisans account, from 2015 until 2019, HerbinArtisans earned a “Total [Gross] Income” of $13,710,069.27 and a “Net Income” of $2,574,850.33.

Search Warrants

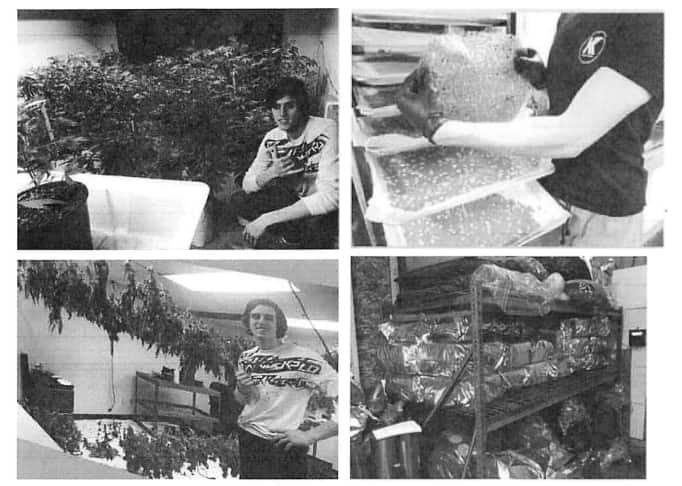

On March 10, 2020, law enforcement officers executed a search warrant at properties associated with the defendants, including a warehouse in Monroe, Washington.

The Monroe, Washington, warehouse used by the Rhule duo.

“Inside a warehouse located on the property, agents found processing equipment and materials dedicated to the extraction and concentration of marijuana including: various types of industrial-grade machinery, steel tables, industrial amounts of dry ice, dry-ice storage bin coolers, metal cylinders of various sizes, flexible metal hoses, pressure cylinders, various pumps, industrial scales, stainless steel pressure cylinders, pressure covers, vacuum pumps, electric motors, a mini dryer, a terpene trap, tube racks, mixers, chemistry mixers, multiple ovens and drying racks containing marijuana distillate products.”

“agents also found approximately 29 large garbage bags filled with marijuana plant material and multiple glass jars containing refined marijuana distillate products. Agents further found a large rotary evaporator with multiple large glass flasks, a heavy-duty press, and a 50-gallon tank of pressurized butane.”

Law enforcement officers found approximately 1,000 kilograms of bulk marijuana or marijuana extracts, including packaging, when they executed search warrants in connection with this case in March 2020.

The Rhules made over $13 million in sales from marijuana distribution but netted only $2.5 million.

The federal government is very concerned that Washington state could not tax the defendants’ marijuana distribution operation.

“…[T]he state has set up a regulatory framework to serve many important purposes, including ensuring the safety of those who produce and consume marijuana products. The state is also, of course, entitled to tax the marijuana industry. Yet the defendants ignored all this. Perhaps, as is so often true in fraud cases, they were motivated by simple greed. But in running their business in this way, they put a lot of people at risk, and disadvantaged others in the industry who chose to play by the rules.”

Judge Coughenour justified the sentence by noting the size of the enterprise and the presence of firearms.

Father and son sentenced to prison for money laundering and illegal marijuana business | archive.is, archive.org, justice.gov