Secret Service Pays Coinbase for Blockchain Analysis Software

The United States Secret Service is purchasing blockchain analytics software from Coinbase, a well-known digital currency exchange.

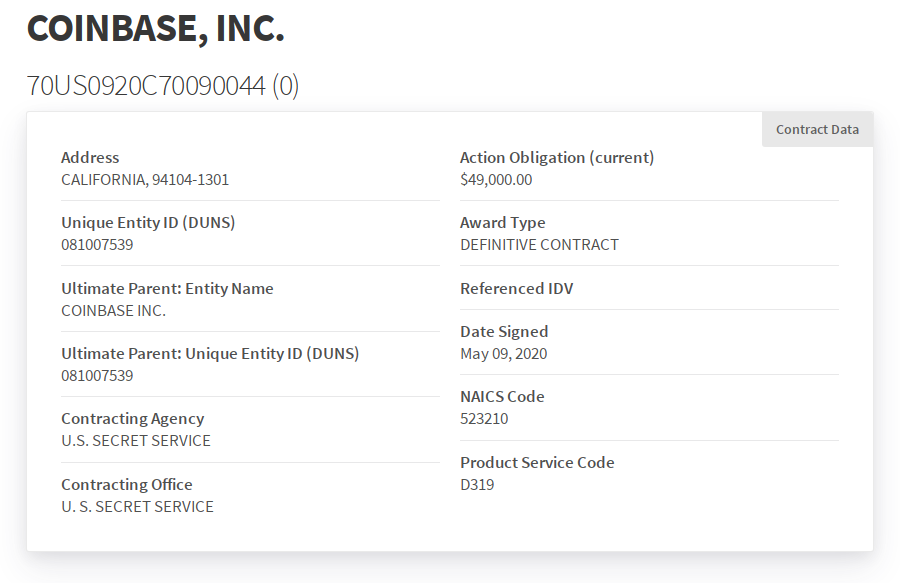

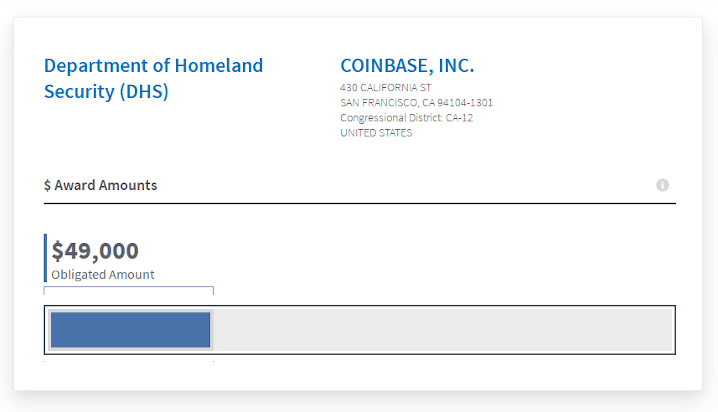

According to publicly available spending records from the United States government, the United States Secret Service awarded a four-year contract to Coinbase earlier this year for access to Coinbase Analytics, the company’s in-house blockchain analytics software. The obligated amount as defined in the contract is $49,000.00

According to The Block, the company created Coinbase Analytics after acquiring Neutrino, a blockchain intelligence platform, in 2019.

Coinbase Analytics data is fully sourced from online, publicly available data, and does not include any personally-identifiable information for anyone, regardless of whether or not they use Coinbase. Coinbase Analytics is a blockchain analytics product that we use internally for compliance and global investigations. It’s an important tool to meet our regulatory requirements and protect our customers’ funds. We developed Coinbase Analytics with technology from the Neutrino acquisition. Coinbase also offers this product to financial institutions and law enforcement agencies to support compliance and investigation use cases. This tool only offers them streamlined access to publicly-available data and at no point do they have access to any Coinbase internal or customer data.

Other law enforcement agencies in the United States also want to purchase licences for Coinbase Analytics. The IRS described their interest in the software in a federal contract opportunity.

As law enforcement techniques evolve and other cryptocurrencies gain acceptance, criminals are using other types of cryptocurrencies, not just Bitcoin to facilitate their crimes. In addition to the Bitcoin Blockchain, Coinbase Analytics (fka Neutrino) allows for the analysis and tracking of cryptocurrency flows across multiple blockchains that criminals are currently using. Coinbase Analytics also provides some enhanced law enforcement sensitive capabilities that are not currently found in other tools on the market. This action will result in a Firm Fix Priced purchase order, Period of Performance: One base year from date of award with one 12-month option.

After articles from Bitcoin.com and The Block, Coinbase CEO Brian Armstrong posted a series of Tweets about Coinbase Analytics.

Blockchain analytics software is nothing new - has been around a long time - it uses publicly available data to try and track crypto transactions - usually to catch bad actors.

Exchanges that maintain connections into the existing financial system (i.e. ability to connect your bank account, do wires, etc so you can convert fiat to crypto) need to follow AML laws, and this often includes utilizing blockchain analytics software for transaction monitoring.·

There is a lot that could be better about existing AML laws, and we didn’t create them - but those are the rules to operate a fiat to crypto exchange legally.

In the early days, Coinbase started off by using some of the existing blockchain analytics services out there. This worked out ok, but the issue with it was that we don’t like sharing data with third parties when we can avoid it, and they didn’t support all the features/chains we needed. So we realized at some point we would need to bring this capability in house.

The Secret Service awarded the contract through the Department of Homeland Security

We did this via an acquisition (which did not go very well honestly, and we had to cycle out some team members). But we were able to rebuild the team, and set up this functionality in house.

It’s expensive to build this capability, and we want to recoup costs. There is an existing market for blockchain analytics software, so we sell it to a handful of folks as well. It also helps us build relationships with law enforcement which is important to growing crypto.

Especially if you want more fiat in the world to flow into crypto over time (as I do). Blockchain analytics software is essentially just compiling publicly available data that is already out there on the blockchain, trying to organize it to make it more useful.

If people want true privacy, that is what privacy coins are for. I’m a fan of privacy coins because I think everyone should have more financial privacy. It will be similar to how the internet moved from HTTP to HTTPS over time.

Whether Coinbase sells blockchain analytics software or not, transactions on public blockchains are still traceable by any number of people out there.

We (at Coinbase) often feel somewhat caught in the middle on this one - we maintain relationships with both the traditional financial world, and the new crypto world, because we act as a bridge between the two. These groups sometimes have different ethos, but it’s important we provide that bridge to keep the flow of fiat and crypto working.

I occasionally see people in the digital currency industry question the value of compliance. By this I mean working with regulators, law…that’s the only way we’re going to get to a truly crypto-to-crypto economy which can have all sorts of new improvements (including better financial privacy).

Use Monero. xmrguide42y34onq.onion, getmonero.org, localmonero.co (localmonerogt7be.onion)