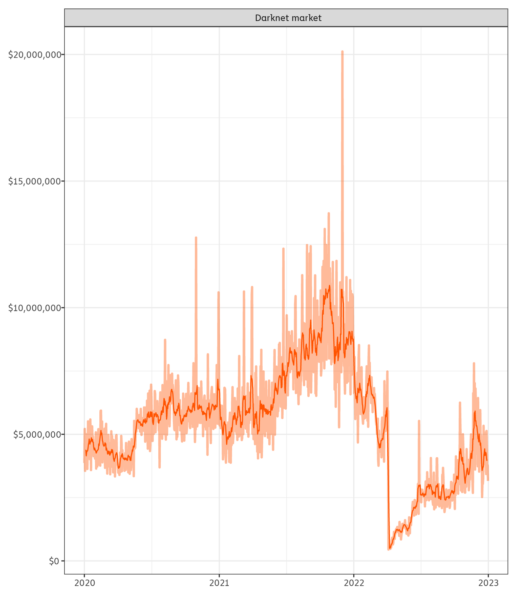

Darknet market revenue saw a massive decline in 2022 due to the takedown of Hydra last April, according to a new report from blockchain forensics experts at Chainalysis. The report’s analysis of the 25 biggest darknet markets and fraud shops – for which they track associated crypto transactions – found that their total amount of revenue declined from $3.1 billion to $1.5 billion, representing a dramatic decrease of about 48.4%.

This decrease could be due to the fact the majority of markets accept Monero. Preventing Chainalysis from tracking their transactions.

The loss reflects not only a downtick in sales of goods and services on such markets but the absence of cashout services provided by Hydra that were used to launder large amounts of stolen or otherwise illicit Bitcoin funds. Hydra was formerly the world’s largest darknet marketplace and was taken offline at the beginning of Apr. 2022 in an international law enforcement operation coordinated by Germany and the US.

The report found that even though Hydra was only in operation during the first quarter of 2022, it still managed to process far more crypto (mainly BTC) deposits than any other market processed throughout the entire year. The next closest three markets were all Russian language markets: Mega, Blacksprut, and OMG!OMG!. ASAP was the first international-oriented market, in the number four position. Other international markets, such as World Market, Abacus, Incognito, processed far smaller amounts of traceable crypto revenue.

The report also found that the Russian language OMG!OMG! market immediately dominated the post-Hydra market share for customers in its region, capturing almost 100% of revenue for the first 50 days after the closure of Hydra. In the months following, the regional landscape became more diverse, with competing markets like Blacksprut and Mega taking away the majority of OMG!OMG!’s revenue share.

Chainalysis concludes that the currently-operating Russian language markets that have shown successes in the battle for dominance thus far are winning revenue share due to their continuation of Hydra’s tradition of employing cashout services. Such services are used not only by market buyers and vendors but by a whole host of other types of users who are looking to exchange crypto for cash in an anonymous, “no questions asked” nature.

The cure is working (;