2022: Companies to Report Payments of $600 or More

Payment services such as CashApp, Venmo, and Zelle are now required to report transactions totaling $600 or more to the Internal Revenue Service.

As of January 1, 2022, payment services like Cash App, Venmo, and Zelle, among others, are required to report transactions that total $600 or more in one year to the Internal Revenue Service.

Forbes tells us how reasonable this is:

The IRS is cracking down on payments received through apps, such as Cash App, Zelle, or Paypal to ensure those using the third-party payment networks are paying their fair share of taxes.

It seems like common sense that the people failing to pay their “fair share of taxes” are the people earning $601 through Cash App.

Previously, the IRS required third-party payment networks to report transactions when the gross payments exceeded $20,000 and had more than 200 transactions per year.

Related: Yellen Defends Proposed Bank Reporting Requirements

The requirement is not limited to Cash App, Zelle, or Venmo; all payment networks, including bank accounts, have the same reporting requirements.

PayPal, the owner of Venmo, published a document with answers to potential questions from their customers. The company broke down the changes as follows:

- 1099-K Threshold Change:

- This new Threshold Change is currently only for payments received for goods and services transactions, so this doesn’t include things like paying your family or friends back using PayPal or Venmo for dinner, gifts, shared trips, etc.

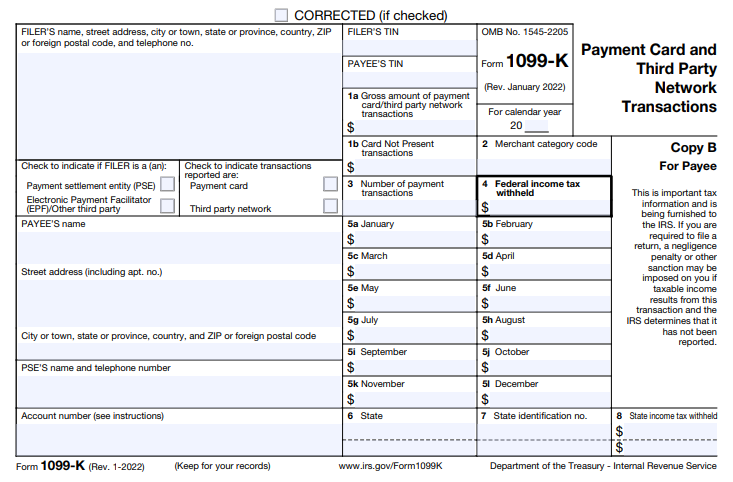

- This change was introduced in the American Rescue Plan Act of 2021, which amended some sections of the Internal Revenue Code to require Third-Party Settlement Organizations (TPSOs), like PayPal and Venmo, to report goods and services transactions made by customers with $600 or more in annual gross sales on 1099-K forms. Currently, a 1099-K is only required when a user receives more than $20,000 in goods and services transactions and more than 200 goods and services transactions in a calendar year.

- In-flow and Out-flow Reporting Changes

- The In-flow and Out-flow Reporting Changes are currently only a legislative proposal, which could potentially be considered by Congress this year. The proposed change would ultimately require all banks and payment service providers, including PayPal and Venmo, to report total inflows and outflows for accounts with at least $10,000 of total deposits and/or withdrawals to the IRS. This is intended to increase the visibility the IRS has into money coming in and out of customer accounts.

- At this stage, unlike the 1099-K Threshold Change, this is just a proposal and the details are still up for debate. As the situation changes, we’ll be sure to keep this updated as we learn more.

If a user transacted more than $600 in one year, the financial service is supposed to send them a Form 1099-K which PayPal described as “an IRS informational tax form used to report payments received by a business or individual for the sale of goods and services that were paid via a third-party network.”

There presumably will not be any changes to the lives of US citizens who file accurate tax information with the IRS. However, considering the apparent need to add almost 90,000 IRS employees, it seems as if the government is anticipating something…

Ah, at least the IRS workforce would grow at a fiscally responsible rate!

PayPal warned:

For the 2022 tax year, you should consider the amounts shown on your Form 1099-K when calculating gross receipts for your income tax return. The IRS will be able to cross-reference both our report and yours.

Should have used Monero?