National Crime Agency Wants to Regulate Bitcoin Mixers

The UK’s National Crime Agency is calling for the regulation of cryptocurrency mixers.

Gary Cathcart, head of financial investigation at the National Crime Agency, said that mixers “can be used to provide a ‘layering’ service, churning criminal cash, obscuring its origins and audit trail, similar to how a cash business might be used by criminals to legitimize cash through the banking system.”

According to the NCA, “regulation would force mixers to comply with money laundering laws, with an obligation to carry out customer checks and audit trails of currencies passing through the platforms.” The NCA said that law enforcement needs to be able to investigate “what is often serious criminal activity.”

The Financial Times first covered the story. The FT piece includes very few NCA quotes but identifies Wasabi Wallet, Samourai Wallet, and Helix as “three well-known services.” Helix’s creator, Larry Dean Harmon, pleaded guilty to money laundering in 2021, leaving only Wasabi and Samourai as the current services named in the article. The piece focused on non-custodial CoinJoin which might be difficult to regulate.

In the Financial Times piece, the author provided examples of the illegal use of mixers. The author wrote that the NCA is concerned about “ransomware attacks, fraud, state-sponsored crime, and terrorism.” Helpfully, the author also included statements from “the world’s oldest and the UK’s leading defense and security think tank,” the Royal United Services Institute.

“However, free and open-source software algorithms in which there is no entity that takes custody of funds cannot be effectively regulated.” Allison Owen, an analyst who leads the Royal United Services Institute’s work on cryptocurrencies and financial crime, said mixers could be used by governments to evade sanctions. “People argue the blockchain has so much transparency when it comes to transactions monitoring, but you still need to make sure the monitoring is taking place,” she added.

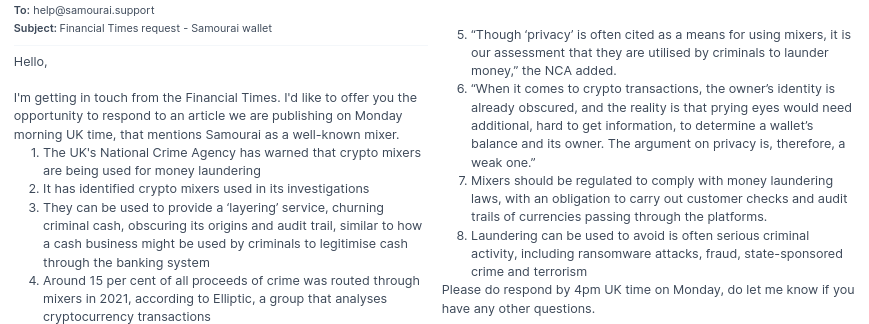

A reporter with the Financial Times reached out to Samourai about the NCA’s call to regulate mixers. Samourai responded with a solid 500+ word email that provided appropriate context to the Financial Times piece. The published article, though, included only one sentence from Samourai.

The email sent from Financial Times to Samourai devs.

Europol also highlighted Samourai Wallet as an emerging “top threat” in 2020 due to its decentralized nature. Samourai said it believes the “vast majority” of users who use this type of CoinJoin software are law-abiding. “We agree that the use of centralized mixers that take possession and custody of funds should be scrutinized and avoided,” the company added in a statement.

Since the Financial Times only published such a small part of Samourai’s response, I included their complete response below.

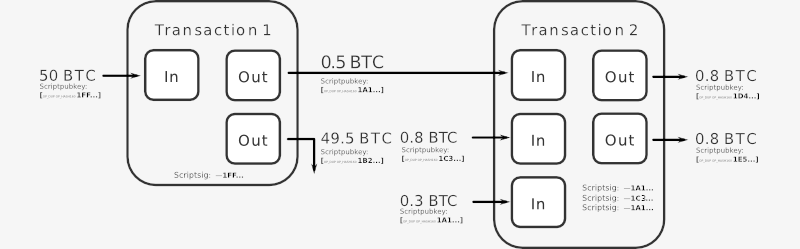

There must be a distinction made between what the NCA has labelled ‘crypto mixers’ and the open source software algorithms that are used in Samourai Wallet, known as CoinJoin. A “mixer” implies a custodial system where crypto is sent into the control of a third party custodian who promises to send back crypto that is unrelated to the deposit. The software that Samourai Wallet produces is fundamentally different. In the Samourai software, users individually collaborate with each other to compose what are known as CoinJoin transactions to themselves. The user retains custody of their bitcoin at all times and a transmission of funds to any third party never occurs.

While it is true that Bitcoin is a pseudonymous system at the protocol level, the vast majority of crypto on-ramps and off-ramps are the custodians of vast amounts of personally identifiable information about their users — to comply with KYC and AML guidelines and regulations.

Several of these custodians have had serious data breaches where this sensitive information is now in the hands of criminals and other bad actors putting innocent users at increased risk of being the target of serious crime like fraud, kidnapping, or worse. With transparent ledgers like the Bitcoin blockchain every transaction is publicly recorded and viewable by anyone indefinitely, a situation no normal person would tolerate in the existing financial system. The existing system has several legislative mechanisms built in that ensure basic privacy (your bank doesn’t share your account balance and transaction history with the barista at the coffee shop for example). The blockchain doesn’t have the luxury of legislative power to solve these problems, therefore software solutions such as CoinJoin are used to obtain these basic protections.

The argument that crypto users identity is obscured on the blockchain so users shouldn’t need to worry themselves with basic financial privacy is not only bad advice, it is a feeble attempt to justify an unprecedented encroachment into the financial privacy of law abiding citizens. The NCA’s remit is to stop serious and organized crime not regulate the behaviour of law abiding citizens.

Elliptic doesn’t provide the underlying data they use to produce these unverifiable numbers. Their methodolgy is often a black box, where headline numbers and charts are presented in lieu of data. Likewise, government contracts play an important part of for profit businesses like Elliptic. It is our contention that these figures are likely overstated. For H1 2021, FINCEN estiamted ransomware, by far the largest illicit use volume of bitcoin, to mixer flows at only 1% (source). Elliptic’s and FINCEN’s estimates are an order of magnitude apart, which implies one of them is wrong.

We believe the vast majority of users who are using non custodial CoinJoin software are law abiding and simply trying to obtain a basic level of financial privacy when using a transparent and public blockchain.

Businesses that take custody of funds on behalf of customers are already heavily regulated. We agree that the use of centralized mixers that take possession and custody of funds should be scrutinized and avoided. However, free and open source software algorithms in which there is no entity that takes custody of funds cannot be effectively regulated. We believe the NCA should instead focus on more productive methods to prevent serious crime and catch criminals.

I hate that I feel the need to point this out but it do be like that. I am not endorsing Bitcoin mixers at all. I like CoinJoin and appreciate Wasabi and Samourai. CoinJoin is not a replacement for Monero (and there is at least one of you who claims Monero is not a replacement for cash or Runescape coins or something). And for all I know, Samourai is a fed op.

Also, I am aware that it is not feasible for a publication such as the Financial Times to publish Samourai’s entire response.

Also, also, “we want to regulate cryptocurrency mixers” sounds like the response to an unprompted question from a journalist asking, “does the NCA want to regulate cryptocurrency mixers?” Do you have a license for that satoshi, mate?

Criddle, Cristina. “NCA Calls for Regulation of Crypto Mixers Used in ‘Churning Criminal Cash’.” Financial Times, Financial Times, 15 Mar. 2022, https://www.ft.com/content/c6df2b68-a244-4560-9911-88cc1fa61576.